The snow has finally melted (well, most of it) and the Spring Market is in full swing in Charlottesville. We’ve actually been seeing some positive signs in the marketplace, including some good news nationally, some encouraging trend lines, and even a fair amount of multiple offers on well-priced properties.

For the first time in about two years, there are some encouraging national trends in the overall economy, as well as in the housing market. Here are a few:

– Foreclosures Decrease in January

According to statistics from Miami-based Bank Foreclosures Sale, an online provider of foreclosure listings and information, foreclosure rates in states across the nation were significantly lower in January. The number of foreclosures for sale fell to 315,710 in January, marking a 10 percent decline from December. These positive figures indicate possible recovery within the housing market, but experts say it is important to note that while this month’s total may be down from December, it is still 15 percent higher than it was in January 2009. Still, a decrease in foreclosure, even on a month-to-month basis, is a step in the right direction.

The statistics for regional markets also showed positive signs. The top-six states for foreclosure rates, including Nevada, Arizona, California, Florida, Texas, and Illinois, accounted for 60 percent of the national foreclosure property total, but Bank Foreclosure Sale said most of these states saw nowhere near the foreclosure growth rates experienced in the past.

Source: DSNEWS.com, Brittany Dunn, (03/02/2010)

– Some National Experts Saying Real Estate Market Is Stabilizing

A number of the industry’s closely watched home-price gauges indicate that stabilization has been slowly creeping into the picture since mid-2009. Analysts at Barclays Capital agree that the tail risk of a sharp decline in housing continues to recede with every passing month. But they caution that there’s still a bit more of a drop in the cards and little chance of sustained gains any time soon thanks to an inflated supply of foreclosures.

Barclays predicts that home prices nationally will drop another 4 to 5 percent before officially hitting bottom. The firm called this further decline “limited” because lately new foreclosure growth has been curbed, which means these properties can be more easily absorbed by the market without pressuring prices down. Mortgage modification programs and other policy measures have ensured that the millions of foreclosures yet to hit the market will do so over an extended period of a few years instead of a few quarters, Barclays said, noting that this smoothed-out supply should limit any future decline in home prices.

Barclays says the stability we’ve been seeing in home prices has been a direct result of slowing down the supply of foreclosures. But the company’s analysts warn that stability in the present comes at a cost to the future of home price appreciation. Barclays expects home prices to remain disproportionately low without any form of a notable rebound for years to come. Source: REALTrends

– Recession Easing in DC

In recent weeks business in Washington, D.C. ground to a halt as record snowfalls pummeled the area and a sparring match over national health care reform hijacked the political conversation. But the nation’s capital is getting something right: It’s emerging from the recession better than any other major city in the country, according to research by Forbes.

Jobs in Washington are growing quickly, and in 2008 the city produced more in goods and services than almost anywhere in the country. D.C. and nine other cities (among them: Boston, Los Angeles and a host of metros in Texas) are best surviving the downturn in part because they specialize in industries that are relatively insulated from economic volatility.

Others in the top 10 include:

2. Austin, Texas

3. Dallas,

4. Houston

(Tie) Minneapolis

6. Denver

7. San Antonio

8. Boston

9. Los Angeles

10. Kansas City

Find out why this is especially good for the Charlottesville real estate market here.

Source: REALTrends

– Beige Book Reports the Economy is Improving

The Federal Reserve’s Beige Book survey of national economic conditions reported that the economy is improving. Bad weather was blamed for slow home sales and construction in New York, Philadelphia, and Atlanta. The Fed also reported sluggish lending with banks still cautious and borrowers reluctant to take out big loans.

Home and condo sales were up in Boston, Cleveland Kansas City, Dallas, and San Francisco.

Source: Associated Press, Jeannine Aversa (03/03/2010) and REALTrends

However, there are still some glaring concerns still looming. For example, the National Association of Realtors (NAR) recently reported that pending home sales were down in all regions throughout the US in December. And there are constant worries that the end of the homebuyer’s tax credit will hurt home sales. Finally, the unknown number of shadow foreclosures (foreclosures that banks own that aren’t on the market yet) is still a big question.

In Charlottesville, signs are mixed, too. However, well-priced homes are selling…and sometimes very fast. Charlottesville home sellers have finally started to adjust expectations and that has helped to loosen up the market.

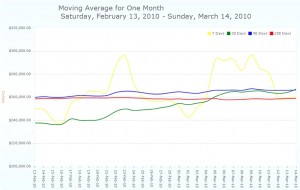

Another encouraging sign: The 200-day moving average for Charlottesville home prices has remained steady. And the 7, 30, and 90-day moving averages have actually shown upward trends…

Don’t get us wrong, we’re not saying we’re out of the woods quite yet. However, we’re finally seeing positive signs and news…and that’s a good thing for Charlottesville homeowners, homebuyers, and sellers.