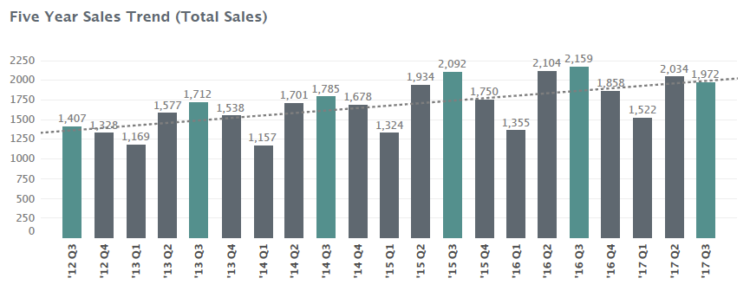

Fall is here and so is the Q3 2017 Asheville Nest Report. Historically in the Asheville marketplace, we see the most sales activity in the third quarter. However, total sales in the third quarter this year were heavily impacted by depressed inventory levels. The declining inventory trend is one we’ve experienced for the past twelve months or so now. Inventory levels for this time of year are the lowest they’ve been in the last four years. Depressed inventory levels is a trend experienced nationwide over the last year and has similarly affected sales volumes in markets across the country.

In addition to constraining total sales, the lack of inventory is also leading to increased sales prices. With fewer homes for sales, buyers have fewer options which gives sellers the ability to command higher prices. Across the greater Asheville area, median sales prices increased more than $22,000 compared to the third quarter of 2016. The median sales price increase from September 2016 to September 2017 is even greater at $33,000. Current market conditions are heavily in favor of sellers and make it increasingly important for buyers to be prepared to act quickly.

Continue reading for highlights from the third quarter performance and be sure to read the full Q3 2017 Asheville Nest Report to learn more about the Buncombe, Haywood, Henderson, and Madison county real estate markets.

Asheville MSA

- Median sales prices increased nearly 10% year-over-year.

- Total sales declined 9% compared to Q3 2016.

- Inventory levels are down 9% compared to the same time last year.

Buncombe County

- Total sales declined 10% year-over-year.

- Median sales prices increased $15,000 from $260,000 in Q3 2016 to $275,000 in Q3 2017.

- Average days on market remained consistent with Q3 2016 at 53 days.

Have questions? Contact your Nest broker today to learn more about the current market conditions and find out what it means for you.